Embedded funding search

Embed funding funding directly into your website to instantly have access to over 100 lenders

Example

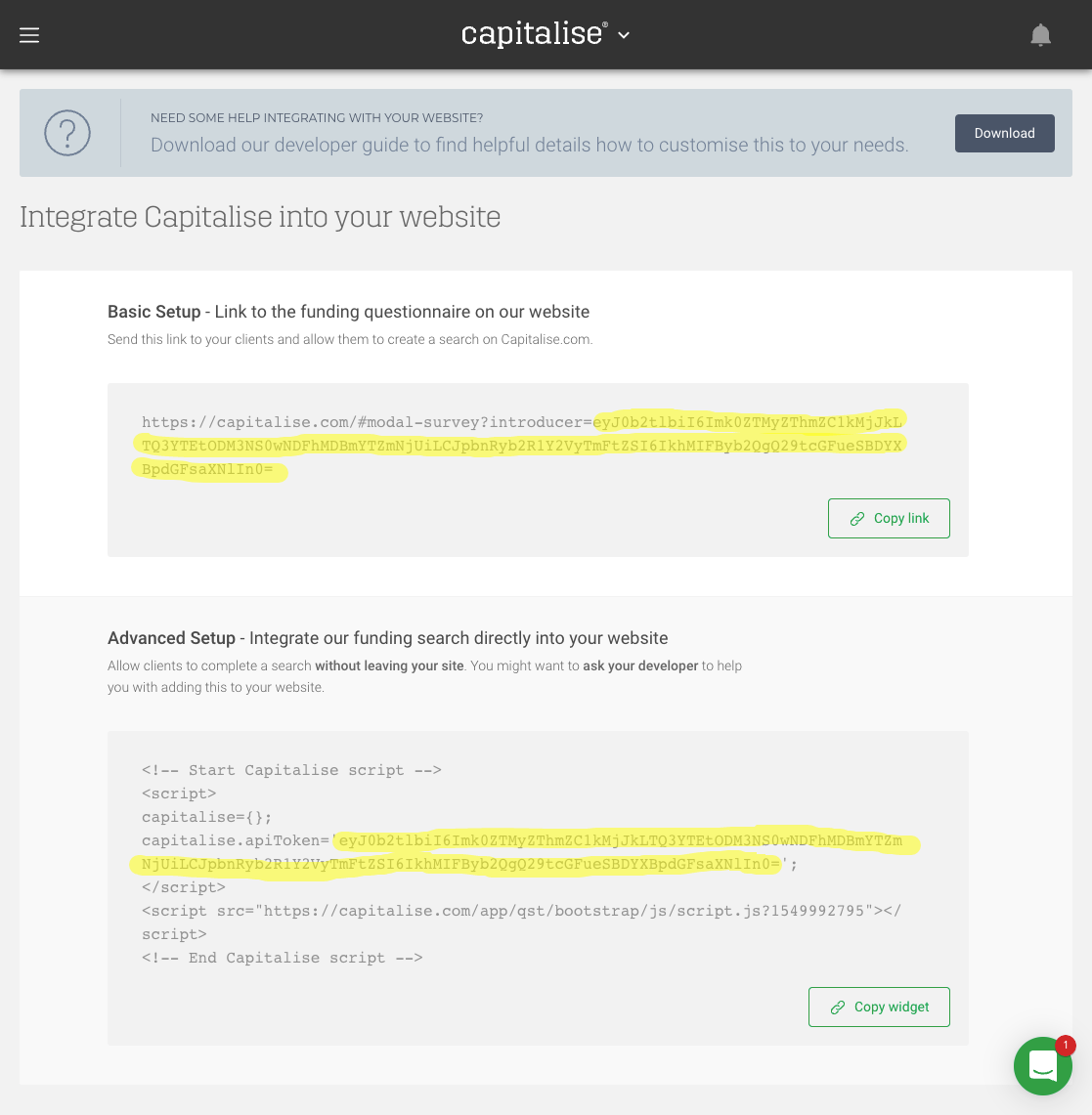

Getting your Introducer Key

Once you've got your account set up by your Partnership Manager, navitagte to Website Integration (Production / Demo) page. You will be prompted to login if you haven't already.

Your Introducer Key is displayed in both highlighted areas - they are identical so you only need to copy once.

- DO NOT change your

Introducer Keybecause it's the unique identifier of your API Partner account - Always double check if your

Introducer Keyis correct before a production release by checking the page in Step 1. You might not be able to receive commission if theIntroducer Keyis incorrect. Introducer Keywould be different between Production and Demo environments- The same

Introducer Keyof an environment can be used for Direct Hyperlink and Embeded Journey via JavaScript Snippets.

Place Embedded Funding Questionnaire

You have two options to embed the funding questionnaire

JavaScript - questionnaire modal

Place below link at the place you want to show the button. You can change the wording and style as you see fit. But please keep capitalise-funding as the one of the class names.

<a href="#" class="capitalise-funding">Get your business funded (in modal)</a>

Add below CSS to before the end of </head> tag to style the modal.

<style>

#capFundQModal {

width: 100%;

height: 100%;

top: 0;

left: 0;

position: fixed;

z-index: 1000000;

}

</style>

Place below the code before the </body> tag and REPLACE_WITH_YOUR_INTRODUCER_KEY with your introducer key. This JavaScript snippet will listen to the onClick of elements that have the class capitalise-funding and show the funding questionnaire in a modal.

If you have the user's consent, you can pass over in the answers parameter so the those answers could be pre-filled. See full list of answers supported.

- Demo

- Production

<!-- Capitalise Funding Questionnaire -->

<script>

function startCapitaliseQuestionnaire(ev) {

ev.preventDefault();

var el = document.createElement("div");

el.setAttribute("id", "capFundQModal");

document.body.insertBefore(el, document.body.firstChild);

capitalise

.init({

referralCode: "REPLACE_WITH_YOUR_INTRODUCER_KEY", // !!! Replace with your introducer key

// Pre-fill answers, optional

// "answers": {

// amount: 25000,

// term: 3,

// useOfFunds: 1,

// companyType: 3,

// sector: 23,

// companyName: "ABC Limited",

// companyNumber: "13390812",

// revenue: 125000,

// contactPhone: '07974678882',

// contactName: 'Joe Bloggs',

// contactEmail: 'joe.bloggs@abc-limited.com',

// invoices: true,

// assets: false,

// epos: true,

// purchaseOrders: false,

// permissions: true,

// clientsType: 3

// }

})

.start.inWrapper("capFundQModal");

document.getElementById("capFundQModal").className = "show";

}

var capitaliseFundingButtons =

document.getElementsByClassName("capitalise-funding");

for (var i = 0; i < capitaliseFundingButtons.length; i++) {

capitaliseFundingButtons[i].addEventListener(

"click",

startCapitaliseQuestionnaire

);

}

</script>

<script src="https://demo.capitalise.com/app/qst/bootstrap/js/script.js?1549992796"></script>

<!-- Capitalise Funding Questionnaire -->

<!-- Capitalise Funding Questionnaire -->

<script>

function startCapitaliseQuestionnaire(ev) {

ev.preventDefault();

var el = document.createElement("div");

el.setAttribute("id", "capFundQModal");

document.body.insertBefore(el, document.body.firstChild);

capitalise

.init({

referralCode: "REPLACE_WITH_YOUR_INTRODUCER_KEY", // !!! Replace with your introducer key

})

.start.inWrapper("capFundQModal");

document.getElementById("capFundQModal").className = "show";

}

var capitaliseFundingButtons =

document.getElementsByClassName("capitalise-funding");

for (var i = 0; i < capitaliseFundingButtons.length; i++) {

capitaliseFundingButtons[i].addEventListener(

"click",

startCapitaliseQuestionnaire

);

}

</script>

<script src="https://capitalise.com/app/qst/bootstrap/js/script.js?1549992796"></script>

<!-- Capitalise Funding Questionnaire -->

Iframe

Alternatively, you can user embed the questionnaire as iframe by below code at the place you want to show the questionnaire. Iframe currently does not support pre-fill answers.

- Demo

- Production

<iframe

src="https://demo.capitalise.com/app/questionnaire/funding/search?introducer=REPLACE_WITH_YOUR_INTRODUCER_KEY"

width="100%"

height="100%"

frameborder="0"

scrolling="no"

allowtransparency="true"

allow="encrypted-media"></iframe>

<iframe

src="https://capitalise.com/app/questionnaire/funding/search?introducer=REPLACE_WITH_YOUR_INTRODUCER_KEY"

width="100%"

height="100%"

frameborder="0"

scrolling="no"

allowtransparency="true"

allow="encrypted-media"></iframe>

Pre-fill answer supported

| Parameter | Description | Format |

|---|---|---|

companyType | The tranding type of the company | Integer Default: Enumerations: 1 Sole Trader2 Limited Liability Partnership3 Limited Company4 Startup |

amount | The amount of fund (business loans) required | Integer Default: |

useOfFunds | The use of funds | Integer Default: 1 Day to day cashflow2 Business expansion3 Equipment/Asset finance4 Refinancing debt5 Import/Export6 Tax bill due7 Acquiring a business8 Starting a business9 Purchasing a property10 Purchasing stock |

term | The term of business loan in months. The value will be rounded up to the closest option below:1-6 6 months or less7-12 12 months13-24 24 months25-36 3 years37-60 4-5 years>=61 More than 5 years | Integer Default: |

sector | The sector of the company | Integer Default: Enumerations: 1 Agriculture2 Automotive3 Business Services4 Construction5 Courier6 Distribution7 Financial Services8 Haulage9 Healthcare/Care10 Hotels/Guest House/Public House11 Import/Export12 IT Related13 Manufacturing14 Print/Publishing15 Professional Services16 Property17 Recruitment18 Retail19 Security Services20 Trade21 Transportation22 Wholesale23 Other27 Education29 Charities31 Media & Entertainment |

companyNumber | The Companies House Number of the company. This number will be used for company lookup. | String(8) Default: |

companyName | The name of the company | String Default: |

yearsTrading | The period that the company has been trading in years | Integer Default: |

revenue | The company's revenue over the last 12 months in Brish Pounds (GBP) | Integer Default: |

invoices | Does the company raise invoices to businesses? | Boolean Default: |

clientsType | What type of businesses does the customer serve? | Integer Default: Enumerations: 1 SMEs2 Large Corporates3 Public Sector4 Consumers |

epos | Does the company have a credit or debit card terminal? | Boolean Default: |

eposRevenue | The monthly revenue through the terminal in Brish Pounds (GBP) | Integer Default: Enumerations: 1 Less than £2K2 £2-3K3 £3-4K4 £4-5K5 £5K+ |

asset | Whether or not the funding is for an asset | Boolean Default: |

assetType | The type of asset that funding is for - only applicable when asset is true | Integer Default: Enumerations: 1 Transportation2 Office3 Stock4 Manufacturing5 A Business |

purchaseOrders | Whether or not the customer receives any purchase order | Boolean Default: |

guarantee | The guarantee(s) that the customer is prepared to offer | Integer1 Personal2 Business3 None4 Both |

contactPhone | The mobile phone number of company contact - currently only accepting the UK number without area code | String(11) Default: |

contactName | The full name of company contact | String Default: |

contactEmail | The email address of the company contact | String Default: |